The market in the greater Bozeman, Belgrade, Livingston Big Sky and surrounding area has stayed resilient in comparison to other areas of the nation, but there has been a slowing of the market and a return to more normal inventory levels – properties are generally on the market for longer prior to gaining a buyer. This is a similar trend to many other mountain markets in the west – but why? The real estate market is local – I’m a big believer in this statement. There is no ‘national’ real estate market – but there are ‘national’ trends that can affect local markets.

Interest rates have played a role, but they are not solely to blame. In fact, we’re finding that many buyers are now understanding that it is unlikely that rates will go down (nor should they at this time) to the historic lows experienced during the years leading up to and during Covid. And they’re moving forward on purchases.

Consumer sentiment overall has suffered due to uncertainty. What exactly has fueled this is hard to pin down – likely it’s a combination of things, financial, pollical and social that have caused general uneasiness. Since there isn’t a specific ‘single event’ it’s hard to say exactly what many people are waiting for when considering a real estate purchase. Much of the urgency is gone but it’s easy for buyers to be lulled into feeling like they have all the time in the world for decisions – multiple offers still happen – and well-priced properties with desirability can go quite quickly.

So, how is the market? Moving but also taking breaths – inventory is returning to pre-covid normal levels. Retaining value but not necessarily culminating in on paper value on sale. Negotiations are common. Reactions to negative news seems to be more swift – positive news is taking longer to have a measurable effect on the market.

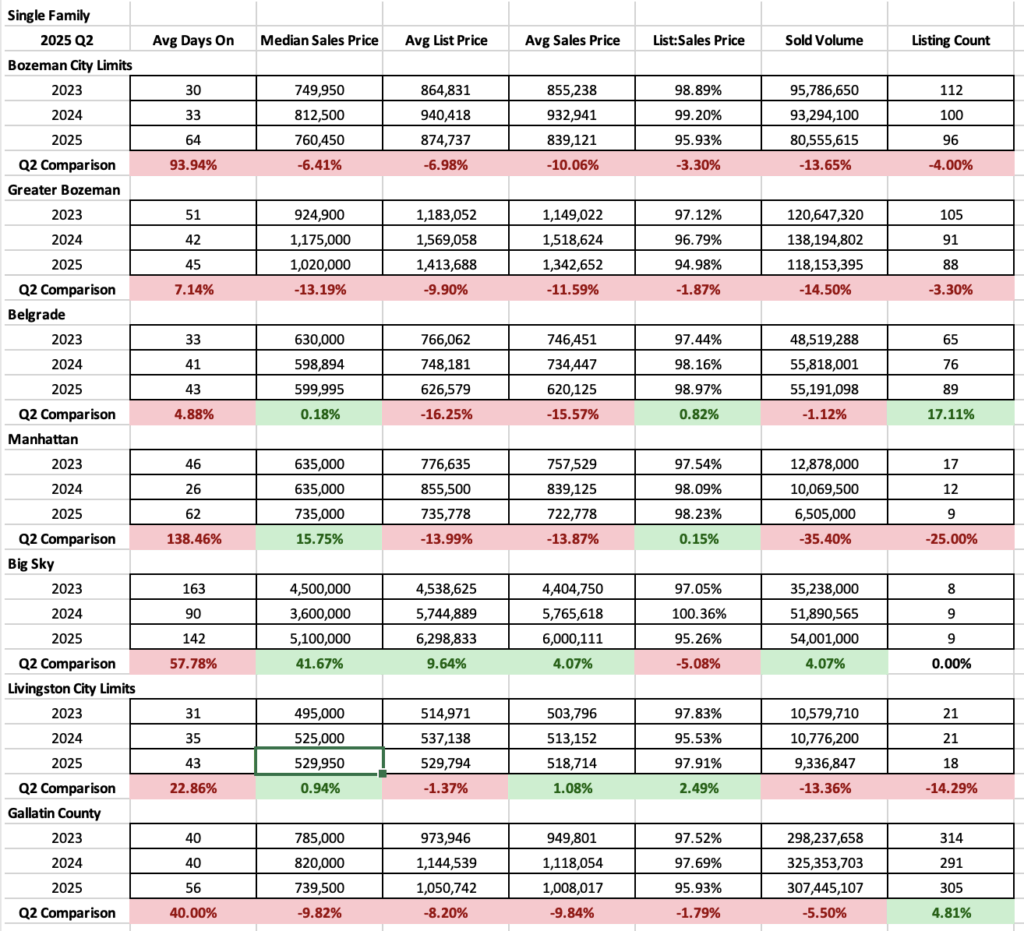

Single Family

Single family median sales prices for Q2 2025 have stayed relatively stable year over year – with prices mostly staying within reach of the median pricing from the same period 2023/2024. Median sales prices for City of Bozeman ($760K) and greater Bozeman ($1.020M) were off from 2024 but up from 2023. Median sales prices for Belgrade ($600K) and Manhattan ($735K) were flat year over year and Median sales prices for Big Sky ($5.1M) and Livingston ($530K) accelerated in 2025 over 2024.

Number of units sold are lower in most areas but not by much year over year – in Bozeman numbers were off 4%, Greater Bozeman off 3% Belgrade was up 17% partially due to the large number of new construction offerings in the area, Manhattan was down 25%, Big Sky was flat and Livingston was off 14%.

List to sales price ratios show that buyers and sellers continue to negotiate – typically properties are undergoing a 1-2% price reduction PRIOR to going pending – and additional discounting on final sales price is ranging from 4% in City of Bozeman, 5% in greater Bozeman, 1% in Belgrade, 2% in Manhattan, 5% in Big Sky and 2% in Livingston.

Average days on market (marketing days before going pending) for sold properties have stayed fairly steady year over year at 45 days in greater Bozeman, 43 days in Belgrade, 43 days in Livingston. Average days on market have increased in City of Bozeman to 64 days, 62 days in Manhattan, and 142 days in Big Sky.

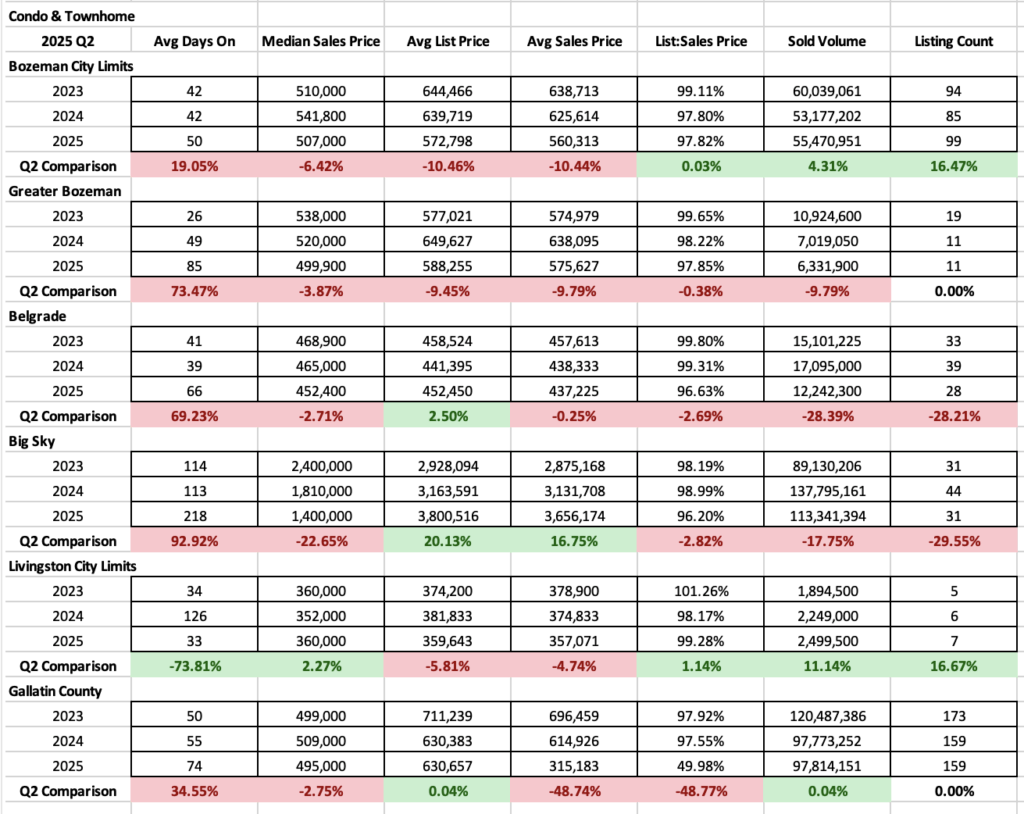

Condo/Townhomes

Condo and Townhome median sales prices have declined in all areas. City of Bozeman is very similar to 2023 pricing but declined 6.5% over 2024 to $507K. Greater Bozeman has steadily declined since 2023 – down 4% off last year to $500K. Belgrade has also declined 3% since 2024 to $452K. Big Sky has taken a sizeable cut to median sales price – down 23% to $1.4M since 2024. And Livingston has increased (2%) slightly year over year but is the exact same median price as 2023 at $360K.

Number of units sold were in line with 2023 numbers – in some cases exceeding and in other cases coming in lower than 2024 numbers of units sold. City of Bozeman was higher than 2024 and about even with 2023 at 99 units. Greater Bozeman area was static with 2024. City of Belgrade was lower than 28% than 2024 at 28 units. Big Sky was even with 2023 but down 30% from 2024 (lots of new construction properties closed in 2024) at 31 properties. Livingston was even with the previous years.

List to sales price ratios indicate continued negotiation between buyers and sellers – as with single family homes, there are between 1-2% price reductions happening on average before properties go pending – and once pending, discounting continues. City of Bozeman condos and townhomes on average were discounted around 2%. Greater Bozeman also was at around 2%. City of Belgrade was at closer to 3.5%. Big Sky was at closer to 4%. And City of Livingston was at 1%.

Average days on market were higher or flat in all. City of Bozeman is up 20% to 50 days on market. Greater Bozeman is up 73% to 85 days on market. Belgrade is up 70% to 66 days on market. Big Sky is up 92% to 218 days on market. Livingston is flat at 33 days on market – tracking 2023 and is about even for a market without new construction input at this time.

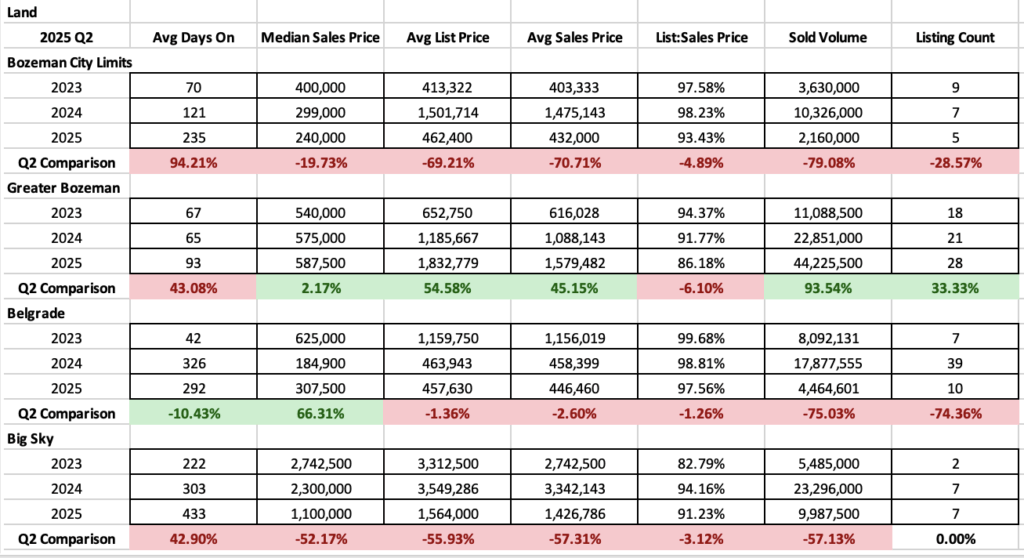

Land

Median sales prices on land tell a varied story – City of Bozeman land sale median pricing has dropped significantly since 2023 – down another 20% from 2024 to $240K. Greater Bozeman median pricing is climbing year over year – up 2% from 2024. City of Belgrade median pricing has also spiked – but is down from 2023 – 2024 had a bunch of new development lots that sold which deflated median sales for that year. And Big Sky id down significantly to $1.1M for median sales price – this is a 52% decline.

Number of land sales was pretty flat year over year in all areas tracked with the exception of Greater Bozeman which interestingly had a spike in sales in Q2 2025.

List to sales price ratios were a larger spread with land – which is typical of land sales. Discounts prior to properties getting an offer ranged from around a 1% discount for the areas around Bozeman to a 5% discount in Belgrade prior to offer and a 12% discount in Big Sky. Once an offer was made, additional discounting off list price on averages was 5% in City of Bozeman, 12% in Big Sky, 3% in Belgrade and 4% in Greater Bozeman.

Average days on market for sold properties were up in all areas with the exception of Belgrade. Bozeman City limits was up 94% to 235 days on market, Greater Bozeman was up 43% to 93 days on market, Belgrade came down 10% to 292 days on market. And Big Sky was up 43% to 433 days on market.

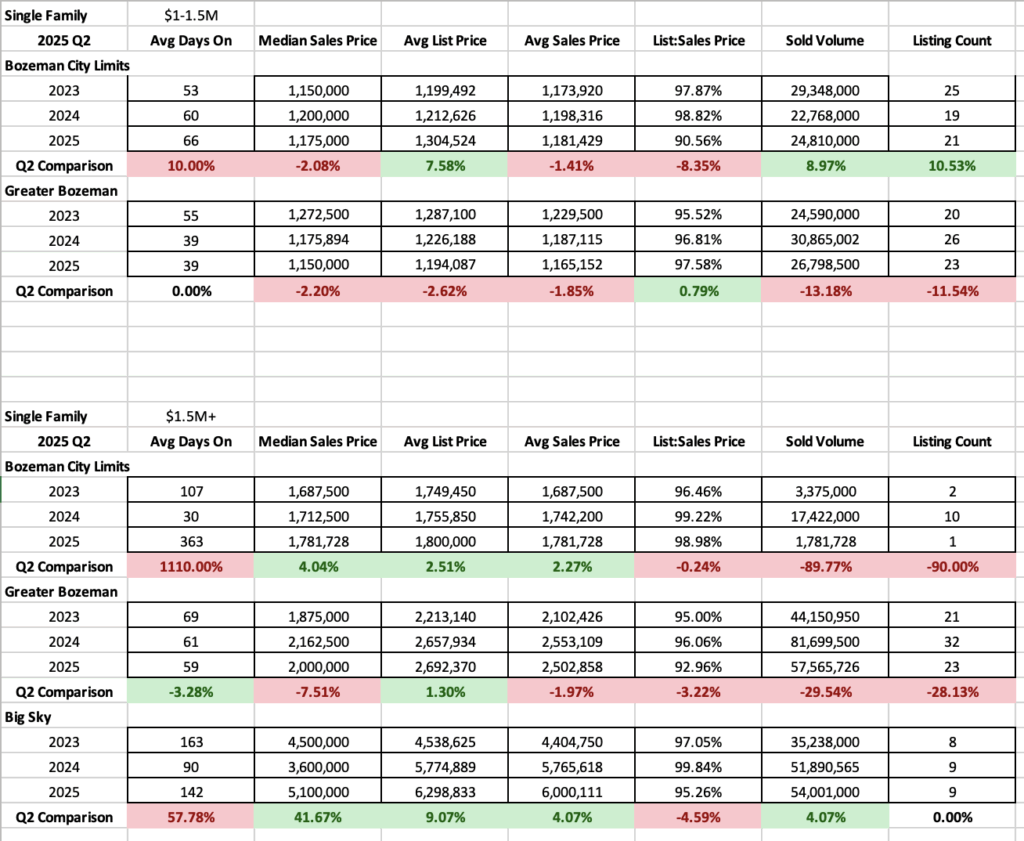

High End and Luxury

Single Family

High-end single-family home number of sold listings (those $1M-$1.5M in closed price) in the two areas tracked (City of Bozeman, greater Bozeman) rose in Q2 2025 in City of Bozeman – up 10% to 21 sales. Greater Bozeman was flat with 2024 with 23 sales. List to sales price ratios indicated heavy discounting in City of Bozeman – with 9.5% average discounting between list and sales price and 2.5% discounting in greater Bozeman.

Luxury single family home number of sold listings (those $1.5M and higher in closed price) in the three areas tracked (City of Bozeman, greater Bozeman and Big Sky) dropped significantly in City of Bozeman – down 90% to 1 property – and fell in greater Bozeman – down 28% to 23 properties- and Big Sky – static year over year at 9 properties. List to sales price ratios showed discounting of 1% in City of Bozeman (flat with 2024), 7% in greater Bozeman ( up 3% from 2024) and 5% in Big Sky (up 4% from 2024)

Condo/Townhomes

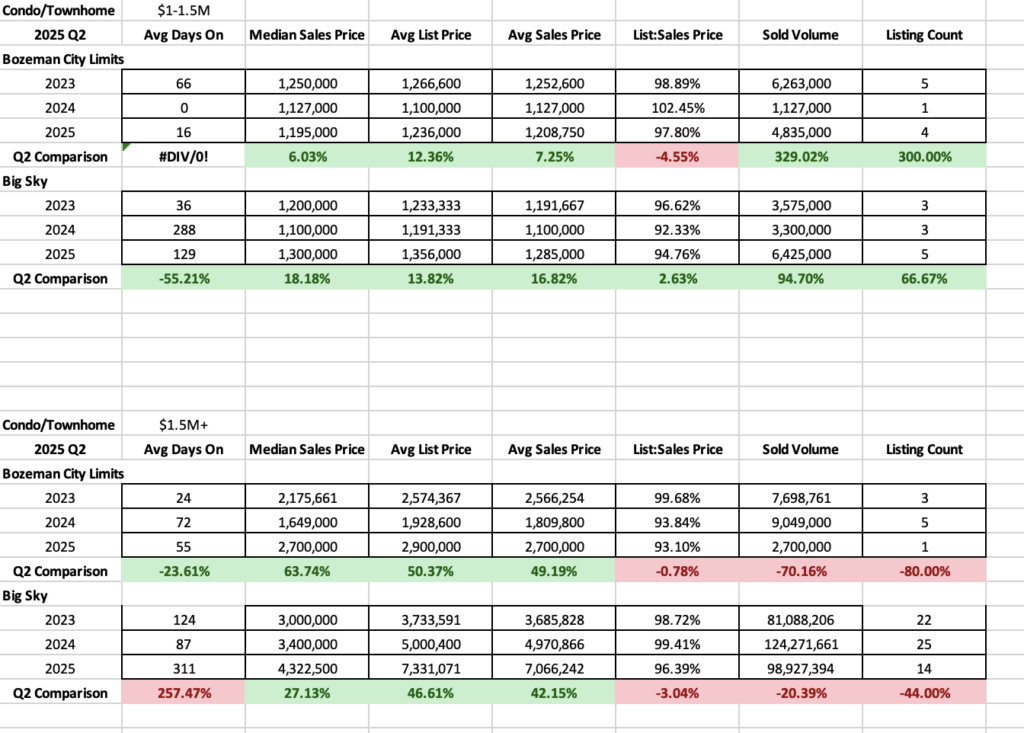

High-end condo and townhome number of sold listings (those $1M-$1.5M in closed price) in the two areas tracked (City of Bozeman and Big Sky) rose in City of Bozeman to 4 units – on par to 2023. Some of this is affected by new construction projects being deliverable. Big Sky also rose to 5 sales. List to sale price ratios fell to 2% on average in City of Bozeman and bettered in Big Sky to 5.25% on average.

Luxury condo and townhome number of sold listings (those $1.5M and higher in closed price) fell dramatically in City of Bozeman – down 80% to 1 listing. Big Sky also fell 44% to 14 listings. List to sales price ratios were fairly flat for Bozeman with 3% discounting. And in Big Sky, discounting increased to 3.5%.